Get TAA Compliant – False Claims Act Attorneys & TAA Compliance Lawyers

GSA schedule holders, product manufacturers, prime and subcontractors are all subject to the Trade Agreements Act (TAA). Whether you are an IT contractor or medical equipment product seller, selling to the federal government can incur substantial civil and criminal exposure if your products are not compliant.

GSA schedule holders, product manufacturers, prime and subcontractors are all subject to the Trade Agreements Act (TAA). Whether you are an IT contractor or medical equipment product seller, selling to the federal government can incur substantial civil and criminal exposure if your products are not compliant.

Our TAA compliance lawyers help clients on their journey to becoming TAA compliant. Get help with civil investigative demands (CID), subpoenas, indictments, and legal defense for both civil and criminal defense.

The TAA was designed to encourage foreign countries to enter reciprocal government-procurement trade agreements. Those agreements prohibit foreign countries from discriminating against American-made products and prohibit the United States from discriminating against foreign-origin products.

The FAR defines a “U.S.-made end product” as follows:

U.S.–made end product means an article that is mined, produced, or manufactured in the United States or that is substantially transformed in the United States into a new and different article of commerce with a name, character, or use distinct from that of the article or articles from which it was transformed. See FAR 25.003.

If you are not Trade Agreement Act TAA compliant, be mindful that the federal government (Department of Justice (DOJ and OIG)) is targeting companies nationwide that are non TAA compliant.

The Federal Government has increased its focus on targeting companies that are not TAA-compliant. If you think you have made a simple mistake or that you have nothing to hide and therefore can speak to agents without legal counsel. You may want to revisit that thought.

- Sellers, Manufacturers and others doing business, either directly or indirectly with the federal government retain Watson & Associates’ Trade Agreements Act TAA compliance lawyers and government contractor attorney to help with determining if their products are Trade Agreement Act compliant by assessing the origin criterion and or requirements for being substantially transformed.

- We help suppliers, manufacturers, sellers, dealers and government contractors within the United States and overseas to assess their processes for determining if they have TAA compliant products and defend against False Claims Act charges.

When the DOJ or OIG has you in their crosshairs, you must act immediately. Do not wait to see how “things play out.”

Areas of TAA Trade Agreement Compliance We Handle

- Corporate oversight and internal TAA compliance program

- Help for Government Contractors a pathway becoming TAA-compliant

- GSA TAA compliance disputes for government contractors and GSA schedule holders

- Trade Agreements fraud cases involving federal contractors

- TAA and false claims investigations by DOJ, OIG or other law enforcement agencies

- Trade Agreements False Claims Act defense (Civil or Criminal)

- Indictments

- Subpoenas and Civil Investigative Demands (CIDs)

- Preparation and criminal defense litigation

When government contractors are investigated, indicted, or facing criminal exposure for TAA compliance violations, they are usually also facing TAA False Claims Act liability exposure.

The TAA compliance lawyers at Watson & Associates, LLC, incorporate US Customs’ decisions when determining whether government contractors are Trade Agreement Act compliant.

When bidding on Federal government contracts on GSA FSS schedules and otherwise, please be extremely careful to perform your due diligence for Buy American Act compliance versus GSA TAA compliance requirements.

Who Are Our Clients?

Our law office helps with Trade Agreements Act certification compliance in various industries such as GSA schedule concerns, manufacturers, pharmaceutical company facilities, medical equipment distributors, prime contractors, subcontractors, IT and software companies, service providers, imports, and more.

WATCH THIS VIDEO TO GET THE INFORMATION YOU NEED TO KNOW

The United States is a signatory to the World Trade Organization Government Procurement Agreement. This is another name for the TAA Trade Agreements Act and which is governed by FAR 52.225-5. The President of the United States is allowed to waive Buy American Act (“BAA”) requirements for certain goods from specific countries. If, however, a federal government contract procurement is governed by. The TAA, then the Buy American Act will not apply.

What Are TAA Compliance Requirements?

The Trade Agreements Act (TAA) is a federal law that requires certain products and services purchased by the U.S. government to be of domestic or foreign origin and designated as eligible for preferential trade treatment. It is designed to ensure that U.S. companies receive preference in government contracts, while still allowing imports from countries with which the United States has trade agreements. As such, TAA compliance and country of origin criterion is essential for businesses wanting to win U.S. government contracts and must be adhered to at all times when bidding on these opportunities.

By working with qualified TAA compliance lawyers who can provide guidance on complying with the Trade Agreements Act, manufacturers, resellers and prime contractors can increase their chances of winning U.S. government contracts while staying within the bounds of federal law.

Being deemed “TAA Compliant” is essential for any business that wants to bid on these types of opportunities and should never be overlooked when preparing for this process. A competent lawyer who specializes in TAA Compliance Law can provide invaluable assistance in helping you understand what it takes to qualify as Trade Agreement Act compliant and positioning your company to successfully win U.S. government contracts. If you are found to be non taa compliant, you can face jail time and huge fines.

The TAA allows government program offices such as buy products for the government through GSA to restrict their buying of goods and services to products that are manufactured or wholly transformed in the U.S. or a specific TAA-designated country.

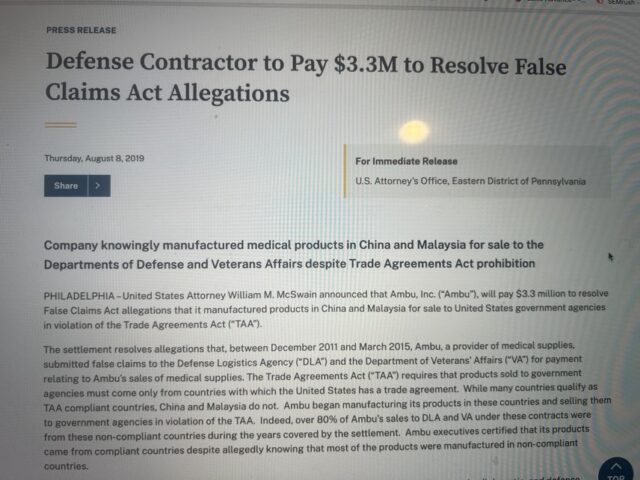

It is not uncommon for the Department of Justice (DOJ), the Defense Criminal Investigative Service (DCIS), OIG or other federal law enforcement agencies to investigate, indict or try to convict government contracts in an effort to resolve False Claims Act allegations for manufacturing products in countries like China and Malaysia for sale to United States government agencies in violation of the TAA Trade Agreement Act. Companies and their CEOs can also face criminal liability for simply submitting invoices to be paid if their products and non TAA compliant.

What is a TAA Claim?

The issue of what is a TAA claim comes to light when there is a whistleblower or Qui Tam case launched against a contractor alleging that the contractor or company is not complying with Trade Agreements Act requirements.

What Federal Agencies Oversee TAA Compliance Fraud Cases?

TAA enforcement issues are overseen by the U.S. Department of Commerce’s Office of Inspector General (OIG). However, for government contracts, the agency makes the decision. The OIG is responsible for investigating any alleged violations of GSA TAA compliance and can impose criminal penalties on businesses that fail to abide by its regulations.

At times, TAA fraud cases may also be handled by other federal agencies, such as the Small Business Administration (SBA) or the Federal Trade Commission. It is important to remember that while these agencies may investigate potential TAA fraud, they do not have jurisdiction over the actual TAA enforcement regulations – that is done solely through the OIG or Department of Justice (DOJ).

What is Non TAA Compliant Under FAR 52-2255? What Are Noncompliance TAA Penalties?

What is non-taa compliant? Because TAA fraud is a federal offense, the non TAA compliant penalties imposed for such violations are often severe. Businesses that fail to adhere to TAA regulations can face civil fines of up to $500,000 per violation, and criminal penalties, including imprisonment and debarment from participating in government contracts or programs.

In addition, businesses found to be non-compliant with TAA laws may also have their licenses revoked or suspended and may be subject to other sanctions as well. Therefore, it is essential that all businesses and government contractors take steps to ensure proper adherence with FAR 52.225-5 TAA compliance requirements at all times when bidding on U.S. government contracts.

Engaging Trade Agreements Acts attorneys who can help your company with Trade Agreements Act Compliance Law can help you avoid costly fines or penalties that can result from TAA non-compliance.

The lawyers at Watson & Associates, LLC Law Firm can provide guidance in Trade Agreements Act (TAA) compliance requirements laws.

AVOID JAIL TIME and HUGE FINES AND START A SOLID LEGAL DEFENSE HERE

What are Examples of DOJ or FBI Cases Where Government Contractors Were Non TAA Compliant?

In recent years, the DOJ and FBI have taken a very hard line on TAA compliant fraud cases. For example, in 2018, the Department of Justice’s Fraud Section and the U.S. Attorney for the Northern District of New York indicted a government contractor for falsely claiming to be compliant with TAA regulations when bidding on federal contracts. The company was charged with making false statements to obtain property from the United States, wire fraud and money laundering – all violations of federal law that could lead to significant penalties if convicted.

In another case from 2017, an individual who worked as a subcontractor for a government contractor was found guilty of violating TAA compliance requirements when obtaining components for an aircraft engine part from China instead of using U.S.-made items as required by the regulations. The individual was sentenced to 30 months in prison and was ordered to pay a $25,000 fine for his actions.

These cases demonstrate just how seriously the government takes TAA Trade Agreement Act compliance fraud, and highlight why businesses interested in competing for federal contracts should take extra care to ensure their operations are compliant with all applicable laws and regulations.

By engaging a Trade Agreements Act Compliance Lawyer at Watson & Associates, LLC your business can avoid costly penalties or criminal charges for non-compliance with TAA regulations when bidding on federal contracts. Watson & Associates’ lawyers practice in this area of federal procurement law and have knowledge of federal contracting rules that can help you remain competitive while avoiding penalties for being non TAA compliant.

How Do You Obtain TAA Certification?

Although there is no official TAA certification, companies can take steps to ensure they are TAA Trade Agreement Act compliant. In order to be considered TAA compliant, businesses must have processes and procedures in place that ensure they only use products from countries that have a trade agreement with the United States, or have received a valid waiver. Businesses should also keep accurate records of all goods and services purchased under GSA schedule contracts in case of an audit.

FAR 52.225-5 &. GSA TAA Compliance Requirements

Yes, GSA contractors and manufacturers must comply with the Trade Agreement Act. The General Services Administration (GSA) Trade Agreements Act (TAA) Compliance governs the purchase of certain goods and services for the federal government from other TAA-compliant countries. The TAA requires that any goods or services purchased by federal agencies must meet a certain standard of “substantial transformation” requirements – meaning that they are increased in value, either through assembly or manufacturing, by either a US company or a foreign producer. GSA Trade Agreements Act certification regulations ensure that all products and services meet the requirements in order to be eligible for purchase by federal agencies.

GSA TAA compliance requirements under FAR 52.225-5 must be met to comply with TAA rules and regulations. These include obtaining the appropriate Country of Origin criterion. If you are investigated or charged with a crime,, our GSA TAA compliance lawyers can help.

The TAA requires federal government agencies to purchase goods and services made in the United States or other TAA countries with trade agreements with the United States. This means that GSA contractors and manufacturers must ensure they are using products and components that meet these requirements when bidding on U.S. government contracts.

Businesses should also be aware of any specific country-of-origin criterion rules for certain items sold under GSA schedule, as well as any special TAA compliance requirements for certain types of goods and services. Trade Agreements Acts attorneys at Watson & Associates, LLC can help businesses understand their specific obligations under this law so they can remain competitive while staying within the boundaries of GSA TAA compliance laws.

Which Countries Are Not TAA-Compliant?

Countries that are not considered TAA-compliant countries and, therefore, goods and services coming from them cannot be sold to the US Government, including China, Russia, Iran, Sudan, Vietnam, Syria, North Korea, and Cuba. Similarly, products made with materials originating in any of these countries are also not allowed. Companies that wish to sell goods or services sourced from any of these countries must receive a valid waiver before doing so.

At Watson & Associates, our team of experienced Trade Agreements Act Compliance Lawyers can help your business understand its obligations under TAA regulations when bidding on U.S government contracts. Contact us today to get started. Call us at 1.866.601.5518 for more information about how we can help you to become TAA compliant.

What is Substantial Transformation for TAA Compliance?

The Trade Agreements Act regulation looks at your product being substantially transformed when it undergoes certain significant changes (manufacturing, assembly, processing, etc.) that result in a distinctive character, name, or use of the emerged new product. Under TAA compliance laws, a “substantially transformed” product is considered to originate from the country where those substantial transformations were made. Call our Trade Agreements Acts compliance attorneys for specific help.

Watch this video to gain more insight on getting your company TAA compliant.

If your assessment of TAA Substantial Transformation is Carefully Done, Your Company Can Avoid Criminal Liability and Fines

Note to manufacturers and government contractors: It is crucial to consider the country of origin, such as China, when conducting a thorough analysis. Failing to do so may give your opponents grounds to challenge your product based on this fact. To navigate this complex terrain, our TAA compliance attorneys will meticulously examine whether the assembly of components originally from China, in the United States constitutes substantial transformation.

In government procurement cases in involving FAR. 52.225-5, good judicial interpretations pertaining to substantial transformation under the TAA are unfortunately limited. However, courts often resort to referencing decisions related to other customs matters, like marking, when interpreting similar language as found in the TAA. It is worth noting that the test for substantial transformation is specific to the facts of each case. It assesses whether the article has undergone a process that results in a new and distinct name, character, or use. Courts have primarily focused on changes in use or character as the key factors in determining substantial transformation while considering a change in name as the least compelling factor.

Taking into account these intricate details will help ensure compliance with the TAA and enhance the soundness of your business practices in government contracts.

TAA Compliance for Medical Equipment

TAA Compliant IT Products and Equipment

What Products are Exempted When it Comes to TAA Certification?

Certain products are exempted from the TAA compliance requirements. These include medical supplies, food, water and related items needed to alleviate human suffering due to severe shortages in a foreign country, as well as certain consumer goods that are used for recreational purposes. At Watson & Associates, our team of experienced TAA Trade Agreement Acts attorneys can help your business understand its obligations under TAA regulations when bidding on U.S government contracts for software purchases. Contact us today to get started with your TAA certified and compliance letter:.

The responsibility of determining the substantial transformation rests solely with you the contractor, and you have two straightforward options. First, you may seek opinions from The Office of Regulations and Rulings within U.S. Customs and Border Protection, which are based on tariff laws. Second, you may opt for a third-party opinion or make the determination by yourself. GSA employs Industrial Operation’s Analysts (IOA) to check FAR 52.225-5 TAA compliance, and it’s seriously useful! Non-compliance with TAA certification regulations in GSA contractors/suppliers’ cases has led them to have hefty settlements with cases brought under the Civil False Claims Act (FCA).

Government Contractor TAA Trade Agreement Act Attorneys

At our law firm, our dedicated team of TAA Trade Agreement Act attorneys brings unparalleled expertise to the defense of clients navigating the multifaceted challenges of trade agreement compliance. To get your company TAA certified, we offer a comprehensive suite of services that cover every facet of potential litigation.

Whether you’re confronting a government contract investigation, grappling with the complexities of the indictment phase, or in need of robust representation at trial, our seasoned professionals stand ready to advocate fiercely on your behalf. With a track record of navigating these specific legal waters, our commitment is to ensure that our clients are expertly guided and defended at every turn, safeguarding their business interests and reputations.

What Does TAA Compliant Mean?

Goods and/or service is TAA compliant if manufactured or substantially transformed in the United States or in a TAA-designated country. A TAA-designated country is a nation with which the U.S. maintains a trade agreement and regards as a reliable or acceptable procurement source. To be Trade Agreement Act compliant, you must perform your due diligence when selling to the federal government.

What does TAA compliant mean: To be Trade Agreements Act (“TAA”) compliant, your products sold to federal government agencies must come only from countries with which the United States has a trade agreement. This is where Watson’s Trade Agreements Act and FAR 52.225-5 Defense defense lawyers can help. We help by:

- Conducting extensive investigations for TAA compliance

- Representing companies involved in TAA requirements investigations

- Representing clients charged with False Claims Act TAA fraud.

- Litigion and support.

As government procurement fraud attorneys and contractor white collar crime lawyers, we can represent large and small businesses performing under GSA FSS contract vehicles and other federal procurements and who are facing potential civil or criminal liability for violating TAA requirements.

Call us at 1.866.601.5518 for more information about how we can help you to become compliant.

Nationwide Gov Contracts TAA Compliance Lawyers: Our government contracts TAA certification Act compliance lawyers provide legal counsel to federal contractors throughout the United States and overseas including Alabama, Alaska, Arizona, Arkansas, California, Colorado, Connecticut, Delaware, Florida, Georgia, Hawaii, Idaho, Illinois, Indiana, Iowa, Kansas, Kentucky, Louisiana, Maine, Maryland, Massachusetts, Michigan, Minnesota, Mississippi, Missouri, Montana, Nebraska, Nevada, New Hampshire, New Jersey, New Mexico, New York, North Carolina, North Dakota, Ohio, Oklahoma, Oregon, Pennsylvania, Puerto Rico, Rhode Island, South Carolina, South Dakota, Tennessee, Texas, Utah, Vermont, Virginia, Washington, Washington DC, West Virginia, Wisconsin, Wyoming, and Virgin Islands. Call us today for immediate help getting TAA certified. 1-866-601-5518.

DOWNLOAD CRITICAL INFORMATION NOW - START THE PATH TO TAA COMPLIANCE AND AVOID JAIL TIME

Call Our TAA Trade Agreement Act Certification Compliance Lawyers for Immediate Help

If you are supplying, manufacturing or selling products to the Federal Government under a GSA FSS schedule or some other contract vehicle and are being investigated, indicted, or criminally charged for noncompliance under FAR 52.225-5 and False Claims Act violations, please call Watson & Associates, LLC TAA Trade Agreement Acts attorneys and white collar crime defense lawyers for immediate help. Call Toll Free at 1.866.601.5518 for a Free and Confidential Consultation. Speak With Theodore P. Watson, Esquire. Practice Group Lead.